Navigating Navigation: Assessing the Relationship Between Airline Elasticities and Price Setting

Abstract

By dissecting the market with a geared focus on price sensitivities, this article will dictate when the market is most susceptible to buyer activity and promotions. Although there are a plethora of factors to be considered in the consumerist flight experience, this research intends to narrow these implications toward the common determinant of elasticity. Assessment will deliberate the existing operations of consumer expectations and their suggestive role in price-setting. Based on the conclusions in this paper, future studies should consider data consistent with updated innovations and economic changes.

Introduction

The industry for domestic and international travel is, by nature, shaped by the consumers that participate in it. Complex, constantly evolving airfare pricing systems make it difficult for transactions to be equally rewarding for both parties. This elects the question, “How do airlines set prices, and what economic principles guide these patterns in the marketplace?” With an understanding of the procedures in practice by airlines, one may better navigate this industry of navigation. This research will begin with an analysis of consumer behavior patterns and it will reflect how these inform the formulaic recipes curated by plane carriers.

My research will draw from academic journals that all effectually inspire greater profit for airline companies. This provides a unique leverage by illuminating what contemporary aviation industries fail to consider when conducting transactions. My research will provide clarity in the scheming and timing of ticket purchases. With a demonstration of how to maneuver such a market space, it denotes a greater literature on how all choices are followed by equal effects of intention and enterprise.

Consumer Sophistication

To secure a proper, nuanced understanding of consumers, economists consider two different types of consumers: strategic and myopic. Strategic consumers differ from myopic consumers, because of their negotiating strategies. A myopic consumer purchases straight from an airline’s direct website without auditing other options. If a myopic consumer decides not to conduct a purchase at one time, they will never come back to the site of purchase (Li, Granados & Netessine, 2011, p. 2114). A strategic consumer is one who negotiates for the best price. This can consist of participating in promotions/discounts or surveying multiple available options. It is shaped by maximizing long-run utility—strategically timing purchases and obtaining lower prices.

Consumer types extend past these two sectors, branching into different types of sophistication. Economists define these types as perfect foresight, strong form, and weak form. Under perfect foresight, consumers predict future prices perfectly. Under the strong form, consumers take into account how airlines set future prices when forming expectations. Under the weak form, consumers base this expectation on historical information only. It is considered “weak” because historical information is not reliable.(Li, Granados, & Netessine, 2011, p. 2125). Consumers should not use past experiences to navigate future circumstances as airlines are ever-changing in their methodology.

These branches of sophistication are relevant to economists and to airlines because they allude to the level of finesse and expertise of their audience. If consumers are strategic, it suggests that buyers will secure better deals and be more disciplined with the inner workings of the airline’s pricing system. This is ideal for consumers, but not for airlines. A greater quantity of well-versed, strategic consumers means lessened profits for airline companies.

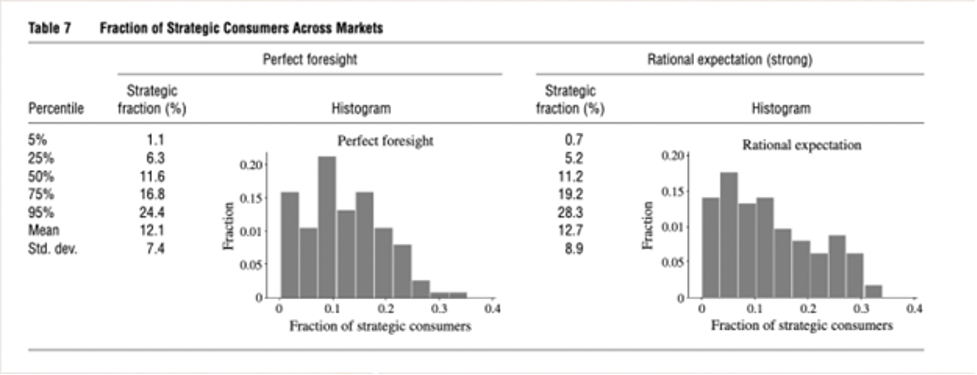

Figure 1.

Fraction of Strategic Consumers Across Markets

Li, Granados, and Netessine: Are Consumers Strategic? Management Science 60(9), 2014, pp. 2114–2137, pg 2128.

Based on Figure 1, approximately ¼ of strategic consumers fall under the category of “perfect foresight.” The fraction of strategic consumers is positively related to the fraction of those with perfect, or at least rational (strong) expectations. Despite the mantra “correlation does not imply causation,” it is proven with a statistical likelihood that consumers with near-perfect foresight or rational expectation are favored to be strategic. By these standards, being strategic offers an advantage in predicting future prices and forming accurate expectations.

Elasticity in Airline Markets

Each product is marketed according to its elasticity, or how price sensitive it is. In economics, elasticity is a measure of the responsiveness of a variable to changes in another variable. It is defined as the percentage change in one variable that results from a one percent change in another variable, all else being equal.

Research presents that certain elasticities favor individualized markets within the aviation industry. The flight consumer market space is narrowed to leisure and business. Leisure markets pertain to air travel for the cause of vacation, personal gratification, etc. This marketplace is elastic, because a substantial raise in price will exponentially impact consumers’ decision to travel. Business markets, however, are inelastic, because regardless of a big change in price, there is a small change in quantity demanded: consumers will likely still purchase the plane ticket.

Such differences in elasticity present airlines with the opportunity to upcharge. Leisure market price tickets have an average elasticity of 1.89 and business markets have an average elasticity of 0.375. (Mumbower et al., 2014, p. 205) If the good, or service being provided, is more inelastic, consumers have a higher demand for the good and thus have a higher tolerance to paying more for it. Thus, airlines price up business flights given the associated urgency to travel. Elasticities help airlines design optimal promotions by considering not only which departure dates should be targeted, but also which days of the week consumers should be allowed to purchase.

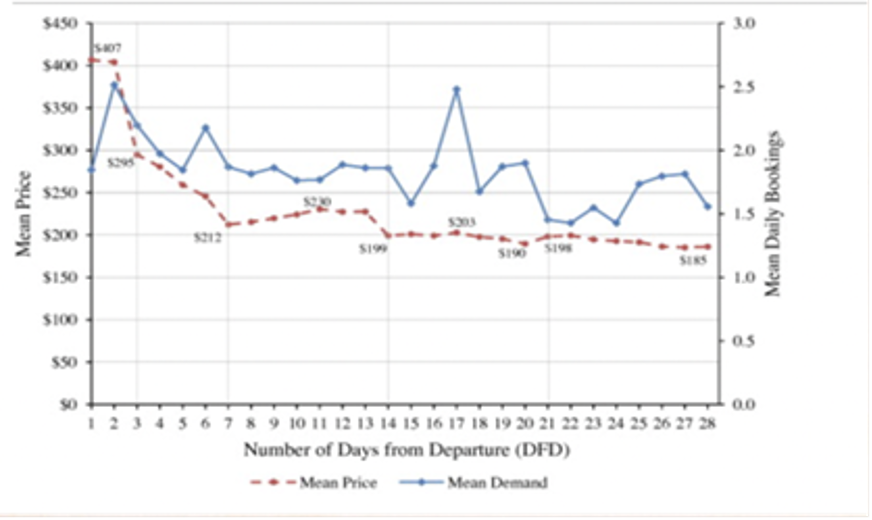

Figure. 2.

Price elasticity results as a function of booking characteristics.

Mumbower et al. / Transportation Research Part A 66 (2014) 196–212, p. 207.

Figure. 3.

Average daily demand and prices as a function of days from departure.

Mumbower et al. / Transportation Research Part A 66 (2014) 196–212, p. 199.

Figure 2 and Figure 3 exhibit how the earlier ahead one books, the cheaper the flights will be. Most leisure flights are booked ahead of time, and business flights are often booked in the weeks/days leading up to departure. These elasticity values in Figure 1 suggest that booking 1–2 days before have the highest inelastic values of -0.57 and -0.73. (Note: take these values into consideration with an absolute value application.) For routes to Orlando (renowned for leisure), most bookings are made in the fourth to third week before departure, and 75% of tickets are sold more than 21 days ahead of departure. For routes to Atlanta (renowned for work/business) most bookings are made in the final week before departure, and only 34% of reservations are made more than 21 days before departure (Mumbower et al., 2014, p. 202).

Elasticities likewise affect the actual day of the week, where Tuesdays and Mondays have the most inelastic values, and Saturdays and Sundays have the most elastic values. This finding is compatible with the price-sensitivity argument for leisure and business flights. Tuesdays and Mondays are customarily the days reserved for work travel, and Saturdays and Sundays for personal/leisure travel.

Elasticities and Promotions

In consideration of flight ticket demand, the allocation of promotionals offers has a further effect on the price sensitivity of consumers. For example, if an airline offers a discount on tickets during a promotional period, they may be able to attract more customers and increase their revenue. However, if the discount is not significant enough, or if it is not promoted effectively, it may not have the desired effect on demand. Alternatively, if the discount is too large, the airline may not generate enough revenue to cover its costs, which could lead to financial losses

Another factor to consider is the income elasticity of demand for air travel. If the demand for air travel is income elastic, it means that consumers are more likely to travel when their incomes are higher. In this case, an airline may consider targeting their promotional offers to specific segments of the market, such as high-income consumers, who are more likely to respond to the promotional offer and increase their travel frequency.

With promotions and deals, consumers become more price sensitive. It is ideal for consumers to purchase from online agencies hosting deals in order to maximize their value. This practice is invariable with the exception of airlines that maintain uniform prices all throughout. JetBlue is one of these, because they don’t overbook flights and so their prices are the same everywhere.

Figure. 4.

Price elasticities during competitor promotions vs. all other dates

Mumbower et al. / Transportation Research Part A 66 (2014) 196–212, p. 207.

The Transportation Research study in Figure 4 analyzed how Jet Blue’s elasticities differ from their competitor, Virgin America’s, promotional sales. JetBlue’s most price-sensitive customers chose to book on Virgin America, whereas the more price-insensitive (and more brand-loyal) customers remained with JetBlue. Figure 4 demonstrates JetBlue’s price elasticities during Virgin America’s promotional sales dates.

These elasticities present that JetBlue’s customers are more price sensitive during Virgin America’s promotional sales. For example, for DFD 22–28, price elasticities are −1.59 during Virgin America’s promotional sales and –1.39 during all other dates. This indicates that consumers favor promotions and will abandon possible airline loyalty if it means that they can minimize costs elsewhere. (Mumbower et al. , 2014, p. 207)

Elasticities and Price Drops

The relationship between price fluctuations and elasticities is characterized by the pronounced influence on demand following a reduction in price. Consider the case of a promotional price reduction for plane tickets. Such an event tends to make individuals who were initially hesitant to book a flight more inclined to do so, thereby engendering a surge in demand for the tickets. However, the extent of this surge hinges on the specific elasticity of demand pertaining to plane tickets. In instances where demand is highly elastic, even a modest reduction in price can result in a noteworthy increase in ticket sales. Conversely, in scenarios where demand is relatively inelastic, a price reduction may exert minimal impact on the quantity of tickets sold.

It is worth noting that the relationship between price drops and elasticities is not always straightforward. In some cases, a price drop may have little effect on demand if consumers perceive the product as low quality or if there are no substitute products available. (Homsombat et al., 2014, p. 4) Additionally, consumers may become accustomed to lower prices and may be less willing to pay higher prices in the future, which could lead to a decrease in demand once the promotional price-drop period is over.

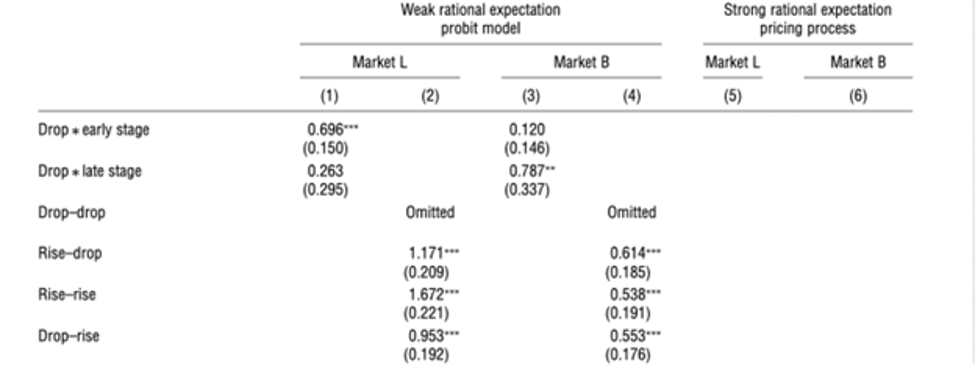

Figure 5.

Models Predicting Future Prices and Trends

Markets L and B. Li, Granados, and Netessine: Are Consumers Strategic? Management Science 60(9), 2014, pp. 2114–2137, p. 2126.

In Figure 5, the values in columns (1) and (3) show that a price drop is likely to be followed by another price drop. However, in different markets, this effect can occur in different booking periods. In leisure markets, an early price drop is likely to be followed by another drop. Whereas, in business markets, prices are more likely to increase toward the departure date and a price drop would be a stronger signal of lower demand and thus be likely followed by another drop. Consideration of elasticity enables a maximization of value for present and future present price drops. It is beneficial for consumers to acknowledge such market conditions so as to better make price-conscious decisions.

Conclusion

By conducting a thorough examination of consumer behaviors and airplane ticket price sensitivities, this analysis demonstrates how prices are predictable to a certain extent. An examination of consumer sophistication and elasticities in different markets, promotions, and price-drops underscores the importance of pricing strategies and what it means to navigate them. This enables consumers and airlines to both better maximize their value and enhance their suggestive relationships with one another. Understanding price elasticity of demand is important for businesses to determine how much they can lower their prices without sacrificing profitability, and to develop effective promotional strategies that will appeal to consumers and increase demand for their products.

Sources

Mumbower, S., Garrow, L. A., & Higgins, M. J. (2014). Estimating flight-level price elasticities using online airline data: A first step toward integrating pricing, demand, and revenue optimization. Transportation Research Part A: Policy and Practice, 66, 196–212. https://doi.org/10.1016/j.tra.2014.05.003

Linshi, J. (2014, October 23). The secret to getting a ridiculously cheap Thanksgiving flight. Time. https://time.com/3531854/cheap-thanksgiving-airfare/

Li, J., Granados, N., & Netessine, S. (2011). Are Consumers Strategic? Structural Estimation from the Air-Travel Industry. Social Science Research Network. https://doi.org/10.2139/ssrn.1939033

Homsombat, W., Lei, Z., & Fu, X. (2014). Competitive effects of the airlines-within-airlines strategy – Pricing and route entry patterns. Transportation Research Part E: Logistics and Transportation Review, 63, 1–16. https://doi.org/10.1016/j.tre.2013.12.008